Keeping appropriate financial records is essential in the fast-paced business world of today. Strong capabilities for bank and payment reconciliation are provided by both Business Central and LS Central, which can lower inconsistencies and improve control over financial procedures. This blog explores the features and their advantages.

Understanding Payment and Bank Reconciliation

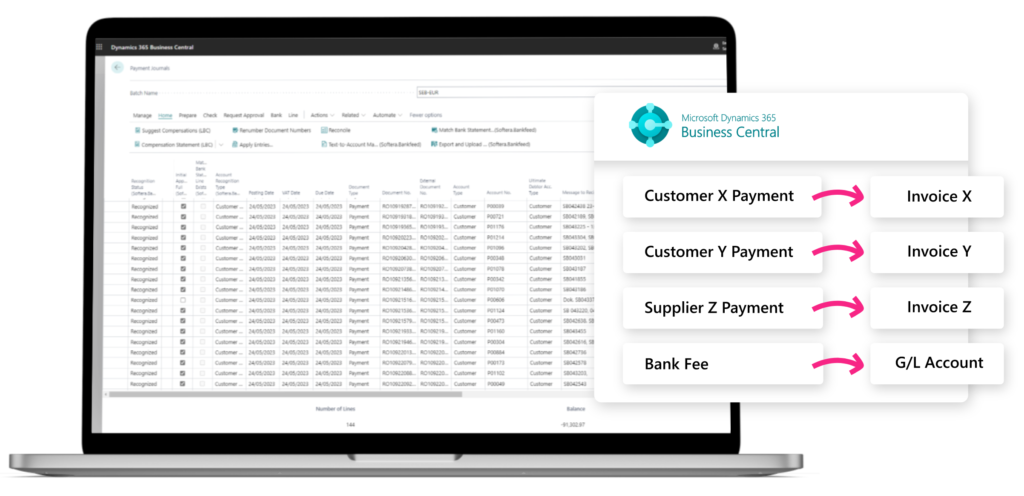

Payment Reconciliation This process involves comparing received funds with unpaid debts. This procedure guarantees that every payment is tracked down and appropriately applied to the relevant invoices.

Business Central

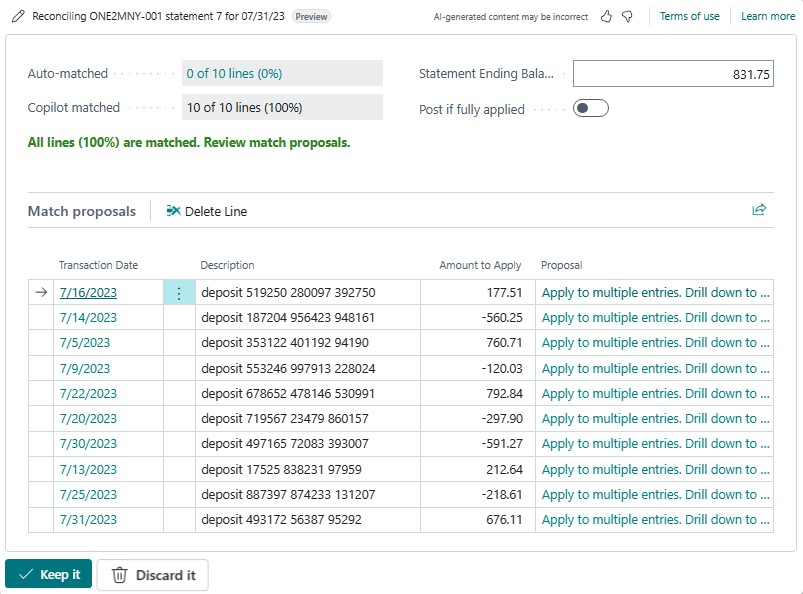

By importing bank statements and automatically matching payments, the Payment Reconciliation Journal helps customers cut down on errors and manual labor. Provides automatic application functionality to reconcile payments by matching text on bank statement lines with open entries.1

Bank Reconciliation is the process of comparing and matching bank account entries made in LS Central and Business Central with bank transaction records. This helps to detect any inconsistencies or missing data by guaranteeing that the records in these systems accurately represent the real bank transactions.

Benefits of Reconciliation in Business Central and LS Central

✅ Reduced Discrepancies: By automatically matching bank transactions and payments, human error is reduced, and financial records are kept current and correct.

✅ Enhanced Control: Organizations can identify and address inconsistencies quickly and avert possible financial problems by routinely balancing accounts.

✅ Improved Efficiency: Finance teams can concentrate on more strategic duties by saving time and money by automating reconciliation procedures.

✅ Better Financial Visibility: A clearer view of the company’s financial situation is provided by accurate and timely reconciliations, which improves financial visibility and facilitates better decision-making.

How to Use Reconciliation Features

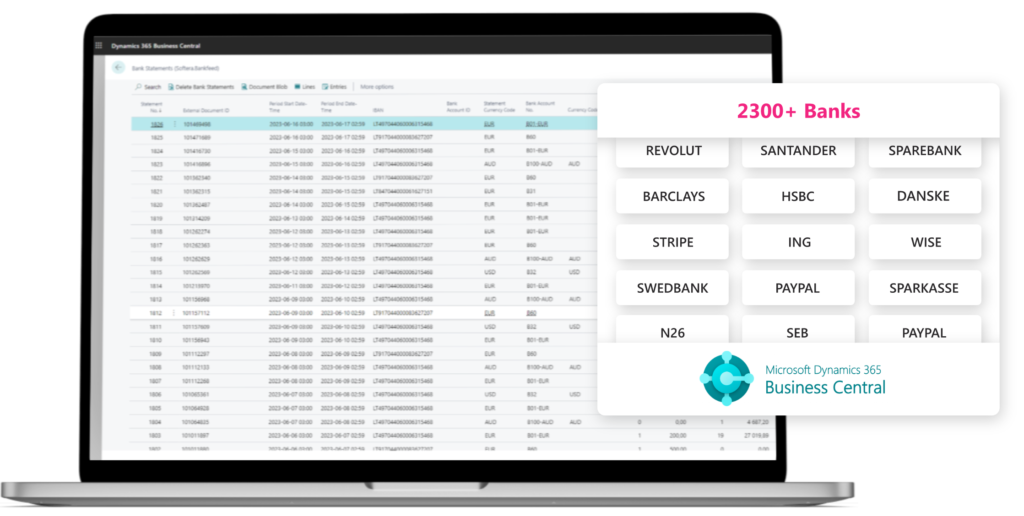

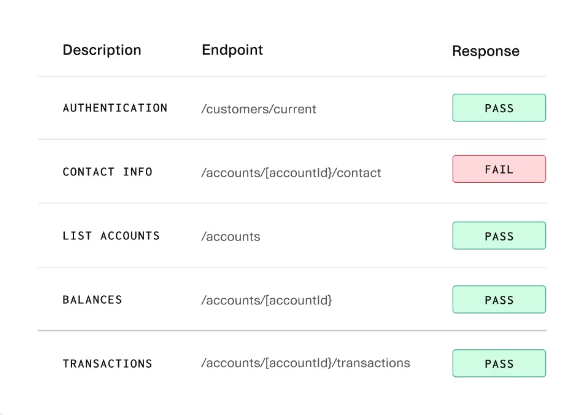

- Creating a Data Exchange Definition or using existing Bank Feeds: There are 2 options to integrate to the Bank, one is to map out the fields and import the statement via a CSV file using the Data Exchange Definition in Business Central. The other is to subscribe to bank feeds, often offered by third parties’ integrators, such as Envestnet Yodlee 2 or Plaid 3 by BankFeed.4 There are fees associated with the subscription, and it does not necessarily work with all bank and bank account types. For example, tokenized logins on the bank portal may not be accepted by the third-party addon.

- Importing Bank Statements: To promptly record payments, users can import bank statements as files or bank feeds. 1

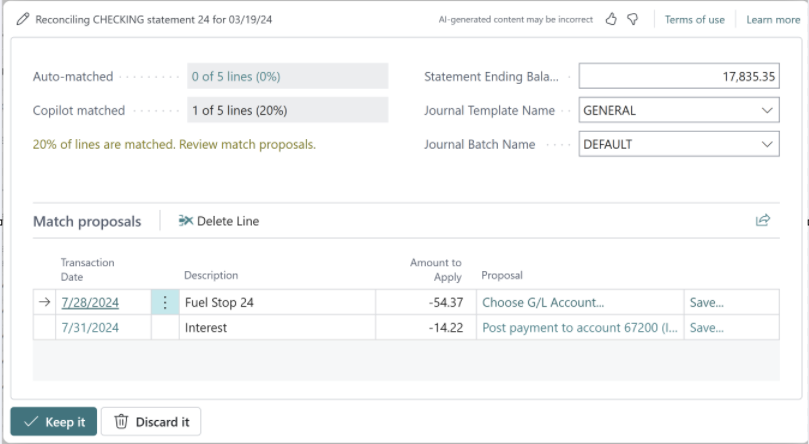

- Reviewing and Modifying Applications: Prior to publishing the journal, users can examine and edit automatic applications.1

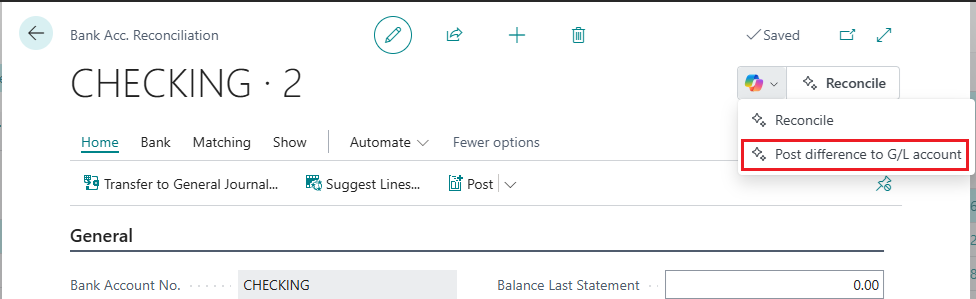

- Closing Open Ledger Entries: When posting the Bank Reconciliation journal, users have the option to close any open bank account ledger entries associated with the applied ledger entries.

- Payment Reconciliation Journal: By enabling users to upload bank statements and automatically match payments with pending bills, the Payment Reconciliation Journal minimizes errors and manual labor.1

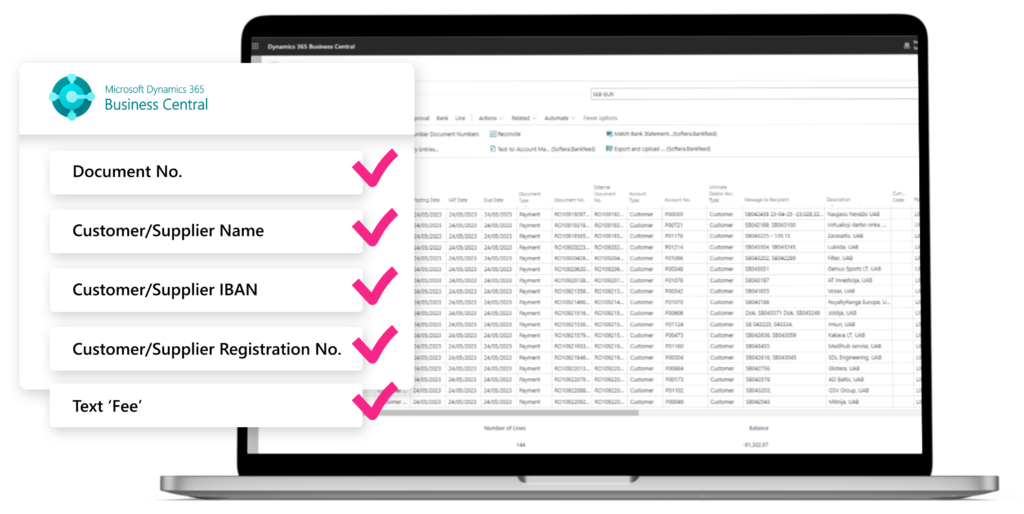

- Automatic Matching: When data on a bank statement line matches data on one or more open entries, the system automatic matching applies payments to relevant open entries. The user can set a date tolerance to let the system match the Bank Ledger Entries to the statement settle date.

- Map Text to Account: It is a powerful tool to map the text of the payments to certain debit, credit, and with the suggestion of the balancing accounts. Such balancing accounts can be mapped to the expense accounts, for example the bank fees or charges, or to apply and recognize Vendor payments and/or Customer Deposits.

- Financial Analytics: Power BI reports, ad-hoc analysis, and integrated financial reports are just a few of the analytical tools that Business Central provides to help you understand financial data.1

- Manual Matching: Each line on a bank statement can be manually selected from both panes to be linked to one or more relevant bank account ledger entries.